Saudi Arabia Ends 80-Year-Old PetroDollar U.S. Agreement: Joins China-Led Central Bank Digital Currency Coalition

Fri 5:45 pm +00:00, 14 Jun 2024

by Brian Shilhavy

Editor, Health Impact News

This past Sunday (June 9, 2024) Saudi Arabia made the historical move to not renew an 80-year-old agreement with the United States that established the U.S. Dollar as the world currency to purchase Saudi oil, in what should have been headline news, but seems to have been blacklisted in U.S. financial news publications, even in alternative financial news publications such as ZeroHedge News.

Here is the coverage of this historic event from the The Business Standard, a Bangladeshi daily newspaper.

Saudi Arabia’s petro-dollar exit: A global finance paradigm shift

The crucial decision to not renew the contract enables Saudi Arabia to sell oil and other goods in multiple currencies, including the Chinese RMB, Euros, Yen, and Yuan, instead of exclusively in US dollars.

Significant financial upheaval is potentially ahead of the financial world as Saudi Arabia has decided not to renew its 80-year petro-dollar deal with the United States.

The deal, which expired on Sunday 9 June, was a cornerstone of the United States global economic dominance.

Originally signed on 8 June 1974, the deal established two joint commissions, one based on economic cooperation and the other on Saudi Arabia’s military needs.

At the time, it was said that it heralded an era of close cooperation between the two countries, says Katja Hamilton of BizCommunity.

This latest development signifies a major shift away from the petrodollar system established in 1972, when the US decoupled its currency from gold, and is anticipated to hasten the global shift away from the US dollar. (Source.)

While I could find no major U.S. English publication covering this as headline news, there was plenty of discussion on Twitter/X.

One U.S. investor, Andrei Jikh, who has over 2 million subscribers on YouTube, published a video on just what the end of the petrodollar means, and that video has accumulated almost 1 million views over the past couple of days.

The video is just over 15 minutes long, but the facts regarding the end of the petrodollar is only covered in the first 12 minutes.

Everything after that is this investor’s views, including his view that people should continue investing in the U.S. Stock market and also invest in Bitcoin, certainly a view that myself and many others would not agree with.

But his summary of the history and significance of the Petrodollar is excellent, and well worth the 12 minutes to watch.

The petrodollar agreement between Saudi Arabia and the United States included more than just the agreement to require the purchase of oil with U.S. dollars, as it also included a promise from the U.S. to protect Saudi Arabia militarily, and also contained provisions for establishing the State of Israel in 1948, something that President Roosevelt actually opposed, but was adopted by his successor, President Truman.

The Quincy Pact

Saudi Arabia reportedly did not renew “its 50-year petrodollar agreement with the United States”, an agreement that expired on Sunday, June 9, 2024.

While it is permissible to doubt the existence of a half-century-long agreement, it was indeed in 1974 that the petrodollar emerged. Three short years after the end of the Bretton Woods agreements.

From a historical perspective, the origins of the petrodollar date back even to 1945.

On his way back from the Yalta conference, President Roosevelt made a stop unbeknownst to the British along the Suez Canal. It was aboard his cruiser USS Quincy that he met King Abdulaziz Al Saud.

It will later be said that this meeting birthed the “Quincy Pact.”

This diplomatic anchorage went so well that Roosevelt offered his wheelchair to the Saudi king, who was also disabled.

Despite this goodwill, the king refused to allow Jewish settlement in Palestine.

However, the American president ensured the essential by sidelining British Petroleum in favor of American oil companies.

This tacit agreement prevented the creation of a Jewish state, but Roosevelt would die two months later. His successor, Harry Truman, would be a strong supporter of the founding of Israel.

He would recognize the Hebrew state 11 minutes after the Israelis declared themselves a nation, against the advice of his Secretary of State.

Henry Kissinger’s Masterstroke

It was in 1974 that the second historic meeting between the Saudis and the American government took place. Henry Kissinger had been Secretary of State for a year.

His mission? To impose the dollar on the ingrates of the old continent who dared to demand gold.

His strategy began with an intervention in favor of Israel in the Yom Kippur War.

[For more context, note that Henry Kissinger is Jewish. He fled Nazi Germany at the age of 15 and would return in uniform five years later to fight in France and Germany.]In retaliation, Arab countries ceased their oil exports, primarily to European nations. The United States, for its part, was self-sufficient. By 1974, the price of a barrel had quadrupled, going from $3 to $12.

This oil embargo was all the easier to implement as the United States had been pushing for years for the emancipation of Iraq, Iran, Kuwait, the United Arab Emirates, Qatar, and Libya from European companies (British Petroleum, Royal Dutch-Shell, and the French Petroleum Company, ex-Total).

Kissinger wanted the price of the barrel to explode to weaken the old continent. He knew well that the American army would have the last word if things escalated, allowing him to impose himself at the heart of international relations.

International discord would reach its peak when President Gerald Ford recognized Jerusalem as the capital of the Hebrew state.

Petrodollar

In response, Saudi Arabia continued to raise the price of the barrel, without knowing that it was playing into the hands of Henry Kissinger, who would ultimately threaten to use force to remedy what he called “the strangulation of the industrialized world”. The London Sunday Times revealed in February 1975 the existence of the “Dhahran Option Four” plan, which planned to invade Saudi Arabia to take possession of its oil wells.

King Faisal would hear these drums of war very clearly. At the end of 1974, he finally gave in to Henry Kissinger’s demands, who promised him the unlimited sale of arms, a backpedal on the Jerusalem issue, and a return of Israel to its 1948 borders (plus a myriad of technologies).

In exchange, Saudi Arabia had to:

1. Sell its oil exclusively in dollars.

2. Invest its dollar surpluses in American debt (It was anyway impossible for a kingdom of 10 million inhabitants to spend the thousands of billions of petrodollars).All OPEC countries would agree in 1975 to denominate their oil in dollars. Here are the broad lines of the genesis of the petrodollar. King Faisal would be assassinated on March 25, 1975, on the day of the Mawlid, the anniversary of the birth of the prophet Muhammad. Subsequently, Israel would never return to its 1948 borders. (Source.)

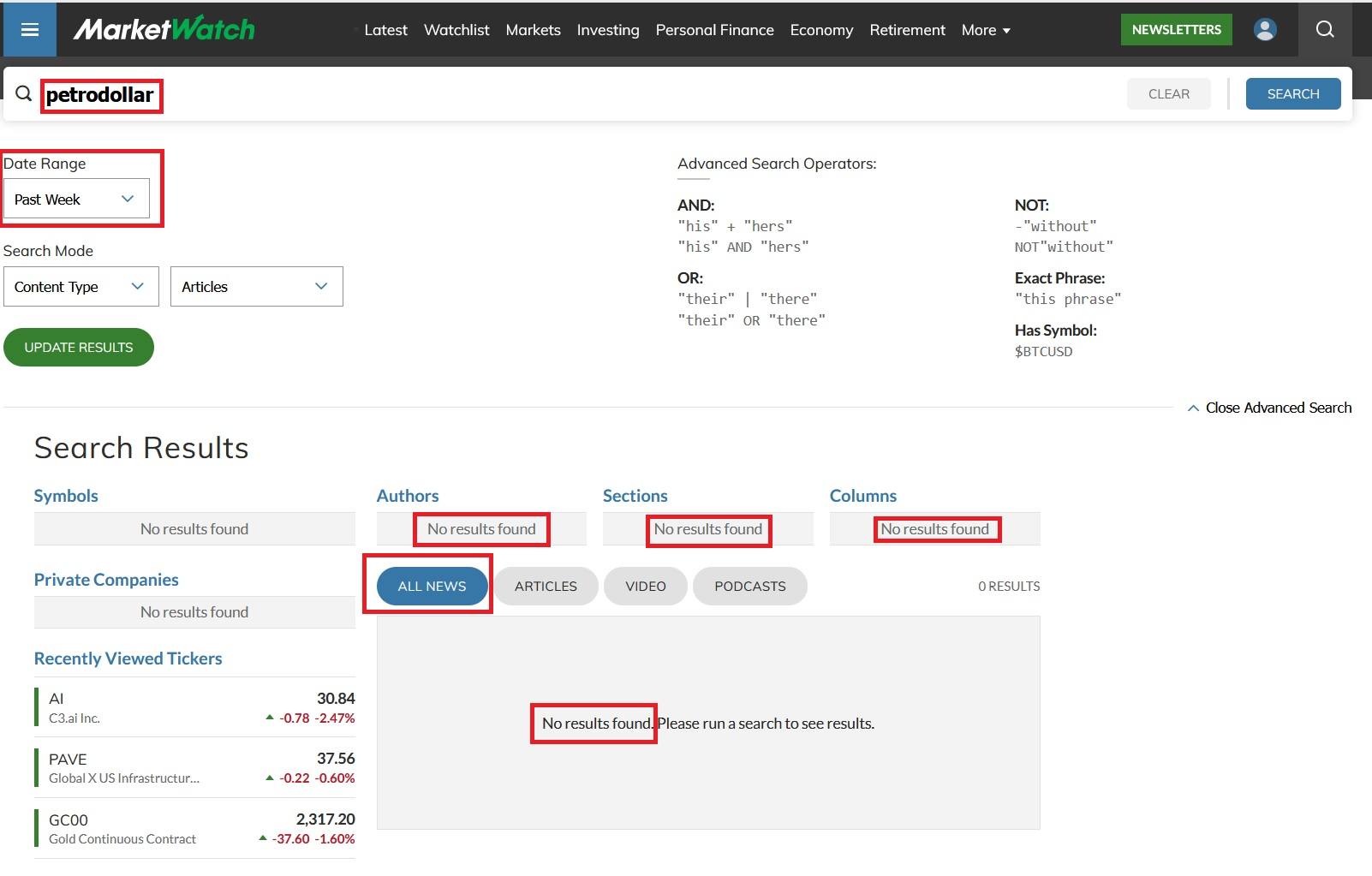

I was amazed that this news of the petrodollar agreement ending Sunday was barely mentioned, if mentioned at all, in the corporate news in the U.S.

I subscribe to Market Watch, a Dow Jones company, and a search I did yesterday for any news on this petrodollar agreement ending this past Sunday returned ZERO results.

However, I did find several articles in the corporate media from recent days reporting that a new deal was expected soon between the U.S. and Saudi Arabia.

Here is one based on an article published in the Wall Street Journal.

US, Saudi Arabia close to finalizing draft security treaty, WSJ reports

The Biden administration is close to finalizing a treaty with Saudi Arabia that would commit the U.S. to help defend the Gulf nation as part of a deal aimed at encouraging diplomatic ties between Riyadh and Israel, the Wall Street Journal reported on Sunday, citing U.S. and Saudi officials.

The possible deal, widely telegraphed by U.S. and other officials for weeks, is part of a wider package that would include a U.S.-Saudi civil nuclear pact, steps toward the establishment of a Palestinian state and an end to the war in Gaza, where months of ceasefire efforts have failed to bring peace.

Approval of the treaty, which the WSJ said would be known as the Strategic Alliance Agreement, would require a two-thirds majority vote in the U.S. Senate, a threshold that would be difficult to achieve unless the treaty were tied to Israeli-Saudi normalization.

The draft treaty is modeled loosely on Washington’s mutual security pact with Japan, the newspaper cited U.S. and Saudi officials as saying.In exchange for the U.S. commitment to help defend Saudi Arabia if it were attacked, the draft treaty would grant Washington access to Saudi territory and airspace to protect U.S. interests and regional partners, the newspaper reported.

It is also intended to bind Riyadh closer to Washington by prohibiting China from building bases in the kingdom or pursuing security cooperation with Riyadh, the WSJ quoted officials as saying.

The White House, the U.S. State Department and the Saudi embassy in Washington did not immediately respond to requests for comment. (Source.)

And here is a contradictory article about a new U.S. – Saudi deal published in The Atlantic from someone who actually went to Saudi Arabia and interviewed people there (emphasis mine).

The Saudi Deal the U.S. Actually Needs

Along-rumored deal to form a strategic partnership between the United States and Saudi Arabia looks doomed to fail because of Israel’s inability to accept a path toward Palestinian statehood in exchange for normalized ties with Saudi Arabia.

As the deal collapses, though, it is worth asking: What kind of relationship should the United States and Saudi Arabia aspire to? What is reasonable for each side to ask of the other?

On a recent trip to the kingdom, I spent a week speaking with Saudis from various backgrounds: wealthy businessmen from the eastern province, young Saudi women starting out in careers unimaginable to their mothers, senior government officials responsible for topics including privatization and foreign policy, and young Saudi men doing everything from starting their own law firm to driving for Uber after their government job had ended for the day.

Beyond their usual warm hospitality, and their patience with my rusty Arabic, I was struck by two things in conversations with Saudis: First, it is hard not get caught up in the infectious confidence they have about the direction their country is headed in. They feel like they are building something new—and judging by the innumerable construction cranes on Riyadh’s skyline, they are.

Second, there is deep frustration and even disillusionment with the United States.

As a former government official, I am used to the regular complaints, such as the tiresome allegations that the United States is “abandoning” the region (despite the tens of thousands of troops that continue to garrison the Persian Gulf).

But I heard newer, more disturbing concerns.

At dinner with a dozen or so older Saudi men one night—almost all of whom had a degree from a U.S. university—I heard real reservations about sending their children and grandchildren to the United States to study: Gun violence, societal divisions, and populist politics in America were all cited as reasons to send their children to the United Kingdom or Europe instead.

One Saudi who had gotten his Ph.D. in the United States worried that “the America I love is tearing itself apart at the seams.”

And for what it’s worth, I heard something very similar from a group of businessmen in Singapore two weeks later. (Full article.)

The first cross-border digital dirham payment was completed by Sheikh Mansour Bin Zayed Al Nahyan, Chairman of the Board of the Central Bank of the UAE, using the Mbridge platform, a central bank digital currency (CBDC) liquidity and interconnection tool. The settlement involved sending 50 million dirhams ($13.6 million) directly to China. (Source.)

While U.S. Bitcoin enthusiasts believe that Bitcoin can replace the petrodollar, all the evidence points in the opposite direction, as it was announced last week that Saudi Arabia has joined the Bank for International Settlements (BIS) Project mBridge, a China-dominated central bank digital currency.

Saudi Arabia Joins BIS and China-Led Central Bank Digital Currency Project

LONDON (Reuters) -Saudi Arabia has joined a China-dominated central bank digital currency cross-border trial, in what could be another step towards less of the world’s oil trade being done in U.S. dollars.

The move, announced by the Bank for International Settlements on Wednesday, will see Saudi’s central bank become a “full participant” of Project mBridge, a collaboration launched in 2021 between the central banks of China, Hong Kong, Thailand and the United Arab Emirates.

The BIS, a global central bank umbrella organisation which oversees the project, also announced that mBridge had reached “minimum viable product” stage, meaning it will move beyond the pro type phase.

Roughly 135 countries and currency unions, representing 98% of global GDP, are exploring central bank digital currencies, or CBDCs. But the new technologies they use makes cross-border movement both technically challenging and politically sensitive.

“The most advanced cross-border CBDC project just added a major G20 economy and the largest oil exporter in the world,” said Josh Lipsky, who runs a global CBDC tracker at the U.S.-based Atlantic Council.

“This means in the coming year you can expect to see a scaling up of commodity settlement on the platform outside of dollars – something that was already underway between China and Saudi Arabia but now has new technology behind it.”

The mBridge transactions can use the code China’s e-yuan is built on. (Source.)

The U.S. Central Bank is not currently a part of mBridge, but one of its branches is, the New York Federal Reserve.

The U.S. has been trying to broker a deal with Saudi Arabia that includes recognition of a Palestinian state since Trump’s Abraham Accords proposal in 2020.

But the ongoing massacre of Palestinians has put any motivation by Saudi Arabia to enter into new agreements with the U.S. on hold.

All the evidence points to Saudi Arabia aligning more closely with China and Russia as they are now full members of BRICS, and more evidence was seen this week when Saudi Arabia’s Crown Prince Mohammed bin Salman decided to skip the G7 Summit currently going on in Italy. (Source.)

Saudi Arabia is also exporting more oil to China now, which is the second largest economy in the world, and is an economy with a net-negative oil balance, as they do not produce enough oil to meet the consumption needs of China, whereas the U.S. now produces more oil than the U.S. population consumes and is an oil exporter.

In recent news, it was announced that China is investing over $1 BILLION in natural gas pipelines in Saudi Arabia.

China’s Sinopec to Build Gas Pipelines for Saudi Aramco in $1-Billion Deal

A subsidiary of China’s energy giant Sinopec has signed a $1.3-billion deal with Saudi Aramco to procure and build pipelines for an expansion of the Kingdom’s natural gas distribution network, the Chinese firm said on Thursday.

Under the turn-key fixed-price contract worth $1.3 billion (5.17 billion Saudi riyals), Sinopec International Petroleum Services Corporation, a wholly-owned subsidiary of Sinopec Oilfield Service Corporation, will be responsible for the in-country procurement and construction of Packages 6 and 7 of the Phase 3 Pipeline Project Clusters of the Master Gas System. (Source.)

The New World Order is rapidly changing right before our eyes, and if you only get your news from U.S. sources, where the U.S. only makes up about 5% of the world’s population, you are only getting the minority view right now, and probably not seeing world events the way the rest of the world is seeing them today.

About the Author

Since I write on such a wide range of subjects, and mostly write on the minority news that very few others will publish, I am often criticized by people who don’t like something I write who email and say something like: “You don’t know what you are talking about. You should stick to the [fill in the blank] topic.”

Of course their motivation for writing this is because they like one topic I expose, and they want to send it to their friends, but then they see something else on another topic I wrote about that they don’t like, and feel like they then cannot forward any articles on the topics they agree with.

So from time to time as new readers come in, it is sometimes necessary to cite my experience.

Since I receive no salary or compensation from my writings, I am free to follow the Truth wherever it leads, regardless of the masses who may disagree with me.

On the topic of this article, I actually worked for Saudi Arabia for several years as an English Professor in the 1990s, at King Faud University of Petroleum and Minerals, which is right next door to the Saudi Aramco corporation.

I taught Saudi students English in the context of the petroleum business for years, training future Saudi business leaders for Saudi Arabia’s oil industry.

Here in the U.S., I have owned and operated an International business for over 20 years where over 50% of our inventory is imported from countries outside the U.S., such as our coconut oil from the Philippines, our grains from Italy, our Extra Virgin Olive Oil and Wild Honey from Chile, our GMO-tested corn from Mexico, along with Black Cumin Seed Oil from Turkey and many other imported products, that forces me to study the markets and the strength of the U.S. dollar, as this is going to greatly affect our business as well.

So before you shoot off an email criticizing me for writing something you don’t agree with and that you feel I am unqualified to write on such topics, you might want to click on the About Us page first.

I am now a “Senior Citizen” with many years of life experience all around the world, and not just some academic “expert” who can put alphabet letters in front of or behind my name.