More Modern ‘Art’ for the Wall of Shame

Sat 11:39 am +01:00, 9 Sep 2023

In the movie ‘Full Metal Jacket,’ Gunny says to Vincent Dinofrio, ‘You’re so ugly you could be a modern art masterpiece!’

Another touchstone moment in Modern “Art” degeneracy occurred in late 2017 at Christie’s in New York. While the world and media focused full-court attention on the sale of renowned artist Leonardo da Vinci‘s “Salvator Mundi” (c. 1500) for $785.9 million, a lesser-known late “artist’s” modernist crap raked in a whopping total of $73.7 million.

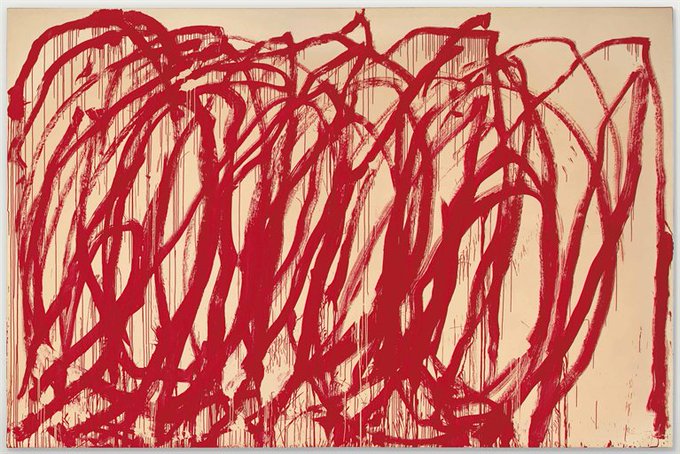

Cy Twombly’s (1928-2011) huge looping red scrawls (see below) titled “Untitled” (2005) sold for $46.4 million with premium. Another Twombly painting titled “Sunset” (1957) featuring the artist’s signature scribblings on a white background sold for $27.3 million. This comes from what is referred to as the “deskilled school of art”.

Wag rag Tate.com bloviates about Twombley’s work thusly:

Red is the colour of wine, but also of blood, and these canvases encompass both the sensual pleasure and violent debauchery associated with the god. This contrast is echoed in the paintings’ combination of euphoric loops that soar upwards and vermilion floods of paint that ooze and cascade down the canvas. The unfurling gestures of these paintings were made, like Henri Matisse’s works in old age, with a brush affixed to the end of a pole, which lends them their vitality and scale.

The exorbitant price that the red scrawls fetched wasn’t a fluke. In fact, it could even be called a bargain. In 2015, another of Twombly’s works — also called “Untitled” and resembles scribbles on a chalkboard (see below) — sold at auction for $70.5 million. The funds raised from the sale financed the construction of the 55,000-square-foot Jewish-center entertainment pavilion for Koreatown’s Wilshire Boulevard Temple, Los Angeles’ oldest Jewish congregation. Isn’t it curious how inflated assets are “monetized” to benefit “certain elites”? What a scam!

In the following humorous and astute critique, Paul Joseph Watson eviscerates the Modern Art movement.

Art Donation as Tax Fraud

In January 2018, federal agents raided four Southern California museums while investigating an alleged tax fraud scheme involving the donation of overvalued Asian and Native American artifacts.

Since the raids, federal agents have seized more than 10,750 objects from the Los Angeles County Museum of Art, the Pacific Asia Museum in Pasadena, the Bowers Museum of Cultural Art in Santa Ana, the Mingei International Museum in San Diego and nine other locations in California and Chicago.

It’s the appraisers — not museums — who determine the value of donated art. But the U.S. attorney’s office in Los Angeles is investigating whether museum officials furthered the scheme by knowingly accepting donations of overvalued art from suspect dealers and collectors over a decade, according to affidavits.

The allegations mirror past tax-fraud scandals in which museums such as LACMA, the Smithsonian and the J. Paul Getty Museum accepted donations of art with grossly inflated values.

Robert Reich, an economist and former Secretary of Labor in the Clinton administration, recently argued, “We’ve created a giant loophole right now through which the rich reduce their taxes by supporting culture palaces frequented primarily by themselves.” In the interview, he added, “This is not the way the tax code was intended to be used.”

Collectors and their agents have continually found creative ways to use their art holdings to defer paying taxes. Some establish private museums and foundations. In some countries, airport-based storage “freeports” allow international “collectors” to store artwork offshore and exchanged without incurring customs duties or VAT taxes, as well as facilitate international money laundering. E.U. Commission President Jean-Claude Juncker enabled the establishment of freeports in Belgium airports when he was the country’s prime minister — and now he’s under investigation for it.

Another exploited loophole in the tax code is “like-kind” exchanges. Originally set up in the 1920s to aid farmers by enabling them to defer taxes on livestock trades, “like-kind exchanges” are now regularly invoked by art collectors in order to avoid paying taxes on the sale of artworks — so long as a collector uses the proceeds of the sale of one work to purchase another within 180 days, the tax obligation can be perpetually kicked down the road.

Art as Leveraged Ponzi Units and Fictitious Capital

Robert Reich, in addition to discussing tax fraud, could just as easily been talking about easy credit conditions fostered by the crooks who run the big central banks. This has cleared the way for speculative and maladjusted artificial wealth for the benefit of super wealthy and their criminal networks.

Art auction houses have expanded into financial services for a range of “UHNWI” clients, offering collectors lines of credit, allowing them to borrow against the value of their collections, and sometimes selling works with third-party guarantees, in which the house effectively pre-sells a lot before the auction and may split some share of the proceeds with the guarantor, if it ultimately goes for more than the agreed-upon price.

Read “The Promotion of Pyramid Scheme Inversion Art”

Art as a Vehicle for Dark World Money Laundering

Georgina Adam, author of “Dark Side of the Boom: The Excesses of the Art Market in the Twenty-First Century,” longtime editor at the Art Newspaper and contributor to the Financial Times, sees artworks often used as a vehicle to hide or launder money. Anonymity in art sales has intensified such conduct.

Art purchasing adviser Maria Baibakova, says, “You don’t really know who they are … because they’re very private. So, buying art as a status symbol falls apart right there because, if you’re buying art for status, you’d want people to know.”

Many auction houses don’t even know who’s art they’re selling. According to the New York Times, if a painting at an auction sells for millions of dollars, the auction house doesn’t get a cent from that sale. Instead, they make their money from the fees charged to the seller for brokering sales. There isn’t a lot of background checking into such sellers or the pieces they want to auction, according to Rashbaum Bowley.

In China, which consistently ranks among the top three largest art markets by value since 2009, demand is being boosted by a government-sponsored museum-building boom. More than 1,000 new museums — a combination of state-run and private institutions — have opened in the past decade. There are approximately 200 privately owned museums devoted to contemporary art. Crucially, building private museums serves not only as a status symbol for the country’s elite but as means of gaining state approval for lucrative real estate development deals.

Source: https://www.winterwatch.net/2023/09/more-modern-art-for-the-wall-of-shame/