Anthony Migchels – Rate Hikes Creating Deflationary Crisis

Wed 10:08 am +01:00, 28 Sep 2022September 27, 2022

It’s all coming together on the timeline, somewhere before Christmas.

And as always when they create problems, leading to reactions, they have ‘solutions’.

“That’s when you really start worrying. The underlying key threads remain the same: the implosion of the American Empire, and the Debt Bubble. These are the issues that need framing, that need to be told.”

The Euro has been worth more than the Dollar for 20 years, but is now standing at a mere $0.97. The Pound has not been as low since 1985. The Yen not since 1998. The Yuan will be forced into devaluation soon.

It’s already a major crisis, and it’s all going to end very badly, not long from now.

People clamor for a new Volcker to ‘fight inflation’. Volcker raised rates to an astounding 19,39% in April 1980, to kill the inflation of the seventies, and resurrect the Dollar.

It’s $90 Trillion.

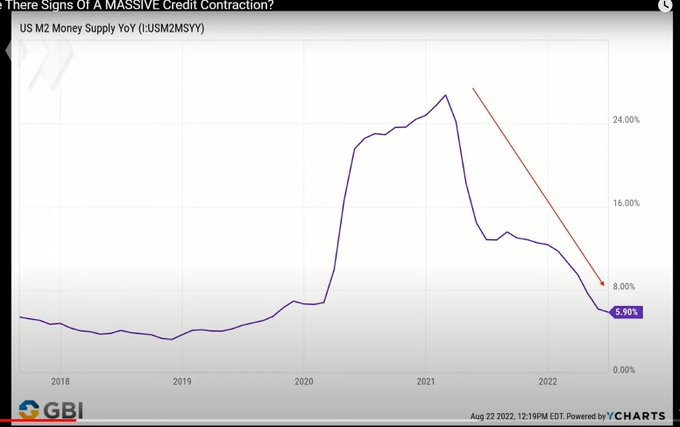

Recently, the Fed pumped up rates with another 0.75%, and its comments threatened more steep hikes in the months ahead. The Fed funds rate now is 3.25%.

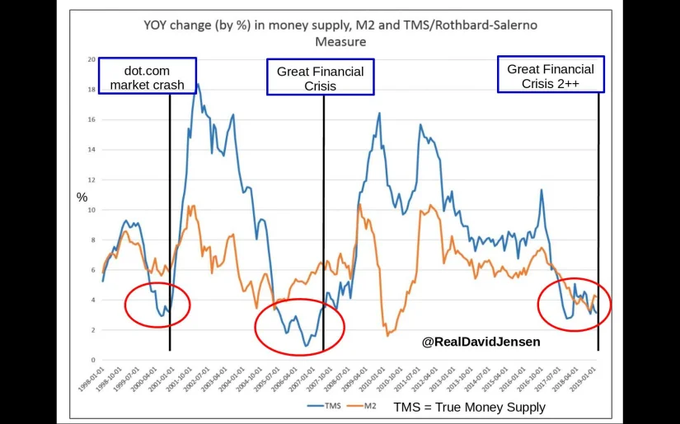

It immediately led to a crash in money growth (M2), leading to the Repo Crisis of September 2019, which in turn led to the Mega Bailout in the week of March 18th 2020, and us getting locked up to prevent a revolt.

Gosh, I wonder what the result will be now?! I’m sure it will be all very different this time. Not.

Remember: the Repo Crisis involved the mass bankruptcy of the biggest banks on both sides of the Atlantic. So it was not ‘just another bust’, it was an almost terminal one. One that is coming back soon. The only question is how soon. Could be months. Could be a little longer. But with the current hikes, and more coming, it’s looking like rather sooner than later.

Government debt service will quickly become unpayable.

As you can see, the Government is now already paying $600 billion per year in interest as a result of the hikes. And the only way is up. At this rate, soon they will be paying a trillion. Which is the entire deficit. And 25% of its total budget, the Government rakes in $4 Trillion per year. No Government has ever survived losing 25% of its budget to interest payments, historically.

The problems are manifold: in the first place, there is a severe shortage of Dollar in Asia. The bottom line really is, that the American economy is simply not big enough anymore to provide all the world with sufficient money without inflation at home. In 1945, the US economy produced half of World production excl. the Soviet block. It’s now about 23%, if we calculate very generously. In real terms, in terms of actual production instead of all the financial nonsense that is counted as ‘GDP’, it’s really much less.

Equally bad is that economies are importing a lot of inflation because their units are declining vis a vis the Dollar. Japan is trying to keep its own interest rates low, but the Yen has imploded as a result. As a consequence, the Japanese felt forced to start propping up the Yen, last week, by selling dollars, and most notably: US treasuries. This immediately led to a further spike of yields on the US treasuries market. Even worse: it sets a very dangerous precedent. If Japan can do it, so can everybody else. And it’s really the very last thing the Petrodollar can use in its final days.

China and Japan are the World’s largest holders of treasuries, and they have both liquidated about 10% of their holdings this year. Yellen was in Japan this year, likely to threaten them to stop. But while US threats are becoming more hysterical by the day, they count for less and less.

Earlier this year, just after the sanctions started against Russia, Moscow soft pegged the Ruble against Gold. And while this did not really last, it was a big shot across the bow. Recently, Moscow has said it could open a Gold Exchange of their own, to rival the COMEX in NYC and London’s LBMA.

The true threat to the Petrodollar this entails, is that it would involve price discovery for precious metals, independent of the West. And without Gold futures to suppress its price. It would mean exploding the Fed’s longstanding game of Gold suppression, exposing not only the true price of precious metals, but especially the weakness of the Dollar and associated currencies (Euro, Pound, Yen).

Not only that: the BRICS nations are planning a kind of reserve currency of their own. In parallel with not so much to the Dollar, but the IMF. Gold will play an important role in that basket of currencies. It will also radically speed up de-dollarization. Already China, India, Russia are using less and less Dollar for trade between them, while this trade is exploding.

Interestingly, in Shanghai Gold is currently traded at a $43 premium compared to prices in NYC. Which is not only sending lots of Gold from the West to the East, it’s also indicating real stresses in the physical vs. paper markets.

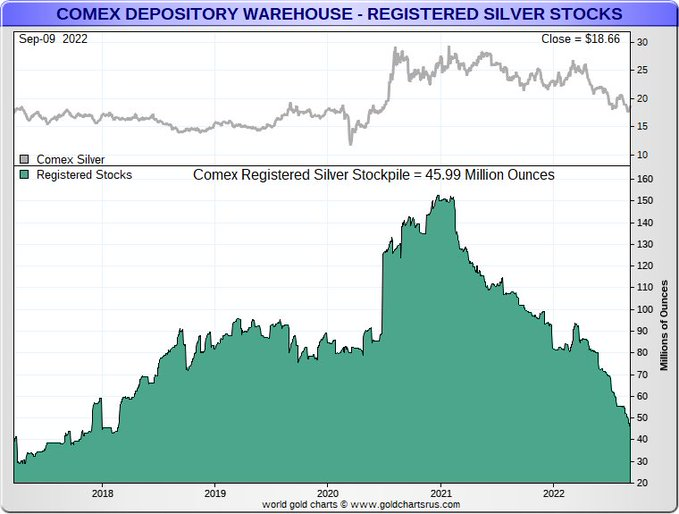

COMEX, the LBMA, and SILVER

For always we have known that there would come a day, that the faux prices for Gold and Silver, suppressed with futures, would at some point get exposed by the COMEX not being able to deliver physical metals at said prices.

In reality, the Petrodollar was already executed in March 2020, when they printed $6 Trillion, $4 Trillion of which went to the Big Banks which were all bankrupt. Here’s Uncle Vlad tearing into ‘the irresponsible monetary policies of the West’, and the disastrous consequences it has had for World Markets.

But Geopolitics has its slow rhythm, and these trends take time to come to their conclusion.

Soon, a major deflationary shock will land on Wall Street, and either there will be a last round of money printing (which will lead to unacceptable asset bubbles and rising prices even worse than we had the last two years), or they will let it go, and bring in their ‘Cyber Attacks’, which they have been signaling for years now, to sell the bail ins (slaughtering defaulting banks and taking deposits) that are unavoidable in the times ahead.

The BRICS nations will distance itself from the Dollar, and will reintroduce Gold as their main monetary base, meaning the New Gold Standard will come from the East. It will lead to the deflation of the debt bubble in the West.

Do not be fooled by the current meteoric rise of the dying Dollar.

A Supernova ends up as a small white dwarf, and so will the once mighty Greenback.

—-

Related:

The Fed Is Pulling The Plug On The Debt Bubble. ‘Cyber Attacks’, Followed By The Greatest Depression Are Coming

The Dying Dollar And The Rise Of A New Currency Order (ten years old! And very relevant now, its predictions are coming true).

The BRICS Bank: Next Stop On The Road To World Currency

https://henrymakow.com/2022/09/anthony-migchels—rate-hikes-.html