Big-Picture Look at Current Pandemic Beneficiaries Accepted by Peer-Reviewed Journal

Wed 5:33 pm +01:00, 16 Dec 2020

CHD Article on Big-Picture Look at Current Pandemic Beneficiaries Accepted by Peer-Reviewed Journal

An article by Children’s Health Defense on how the pandemic facilitated a financial, tech, biopharmaceutical and military-intelligence push for centralized, technocratic control has been accepted by the International Journal of Vaccine Theory, Practice and Research.

By: Children’s Health Defense Team

“Planned Surveillance and Control by Global Technocrats: A Big-Picture Look at the Current Pandemic Beneficiaries,” a peer-reviewed article by Children’s Health Defense, has been accepted for publication in the journal, International Journal of Vaccine Theory, Practice and Research. The journal was launched in 2020 by John W. Oller, Jr., Ph.D. (editor-in-chief) and Christopher A. Shaw, Ph.D. (senior editor) “to make independent research, free from constraints of monetary, political, or any other undisclosed influence, about vaccine theory and practice freely accessible.”

The Children’s Health Defense article, which will appear in the journal by year’s end, assesses how the pandemic has facilitated a financial, tech, biopharmaceutical and military-intelligence push for centralized, technocratic control.

Here’s the article:

Abstract

Global financial patterns and pronouncements point to a seismic overhaul of governance and financial systems that is playing out beneath the surface of the Covid-19 pandemic, reaching far beyond the health domain. Increased centralized control has the potential to create an unbridgeable chasm between a tiny handful of winners and a majority of losers. To foster an integrated analysis of the technocratic and financial forces and agendas at play, this rapid review identifies some of the pandemic’s principal beneficiaries across the interwoven financial, tech, biopharmaceutical, and military-intelligence sectors, assessing developments in the context of the accelerating global push for technocratic consolidation and control. The evidence suggests that Trojan horse coronavirus vaccines may challenge bodily integrity and informed consent in entirely new ways, transporting invasive technologies into people’s brains and bodies. Technologies such as brain-machine interfaces, digital identity tracking devices, and cryptocurrency-compatible chips would contribute to the central banking goal of replacing currencies with digital transaction and identification systems and creating a global control grid that connects the world population to the military-pharma-intelligence cloud of the global technocrats. Moreover, using vaccines as a delivery vehicle for surveillance technologies cancels any legal liability.

Keywords: Biopharmaceuticals; central banks; Covid-19 pandemic; digital identity; Operation Warp Speed; technocracy; vaccines

Introduction

On March 11, 2020, the World Health Organization (WHO) upgraded a reportedly novel coronavirus from a global health emergency (as of January 30) to a global pandemic, having given the name “Covid-19” to the newly minted disease associated with the virus (Forster, 2020; World Health Organization, 2020a). If one examines actions taken both before and since the WHO’s March decree, it seems evident that many highly placed individuals and sectors were able to strategically position themselves to benefit from the declared crisis (Children’s Health Defense, 2020b). At the same time, with a “new form of economic shock” being imposed worldwide under cover of Covid-19 (Lagarde, 2020), it has become apparent that old-fashioned corporate profiteering is far from the whole story.

In fact, global financial patterns and pronouncements point to a seismic overhaul of governance and financial systems that is playing out beneath the surface of the pandemic, reaching far beyond the health domain. These developments highlight a disturbing push for global technocracy — a form of centralized, expert-led control over resource production and consumption that the Wall Street Journal has characterized as “anti-democratic rule by elites who think they know better” (Wood, 2018, 2020; Fitts, 2020a; Schinder, 2020; Schumacher, 2020; White, 2020). In the U.S., many of the actions unfolding behind the scenes are also benefiting from a climate of institutionalized secrecy enabled by the October 2018 adoption of a game-changing policy statement (FASAB Statement 56), which turned financial disclosure rules upside-down to allow the U.S. government and its contractors to maintain secret books (Federal Accounting Standards Advisory Board, 2018; Ferri & Lurie, 2018).

As 2020’s rapid-fire events suggest, substantially increased centralized control and secrecy have the potential to create an unbridgeable chasm between a tiny handful of elite winners and a majority of upper and lower middle class losers. In early June, CNBC’s Wall Street analyst Jim Cramer heatedly pointed out the fact that the pandemic had already produced “one of the greatest wealth transfers in history” (Clifford, 2020). Others have echoed these observations, describing the “monumental transfer of wealth from the bottom of the economic ladder to the top” (Barnett, 2020; Kampf-Lassin, 2020). In comparison to the benefits flowing to large corporations and billionaires, Cramer bluntly observed that pandemic-related restrictions have had a “horrible effect” on America’s small-business economy, with a similar pattern on display outside the U.S. (Clifford, 2020). Even the World Economic Forum — which has promoted many of the structural changes now underway at its annual Davos meetings — acknowledges the “asymmetric nature” of Covid-19-related hardships and the “greater ferocity and velocity” of the pandemic’s impact on populations already under stress before 2020 (World Economic Forum, 2020).

By early fall, fifty million Americans (many with already high burdens of debt) had lost jobs; financial forecasters were issuing warnings about further layoffs; and millions of the still-employed were earning less than pre-pandemic (Andriotis, 2020). In addition, the bulk of the trillions in federal stimulus (which by early May exceeded the gross domestic product of all but six nations worldwide) had made its way to large corporations; Forbes reported that roughly 70 percent of the initial $350 billion intended for struggling small businesses went to large companies (Simon, 2020). Observers suggest that by channeling taxpayer bailouts to the companies that already had the greatest ability to withstand the shutdowns, the largest players have been able to gain even more of a “stranglehold” over the economy (Kampf-Lassin, 2020).

As U.S. billionaires’ wealth increased by almost a trillion dollars (a weekly average of $42 billion), weekly jobless claims, requests for food bank assistance, and reports of addiction, overdoses, depression, and suicide began “shatter[ing] all historical records” (Feeding America, n.d.; Alcorn, 2020; Americans for Tax Fairness, 2020; Baldor & Burns, 2020; Community FoodBank of New Jersey, 2020; Dubey et al., 2020; Ettman et al., 2020; Hollyfield, 2020; Lerma, 2020; Prestigiacomo, 2020; Schwarz, 2020; Sergent et al., 2020; Thorbecke, 2020; Wan & Long, 2020). Outside the U.S., the situation is similar (Bueno-Notivol et al., 2020). As a marker of the global surge in hunger, the Nobel Committee awarded its 2020 Peace Prize to the World Food Programme, prompting the agency’s head to warn that the world is “on the brink of a hunger pandemic” that could result in “famines of biblical proportions” in the coming year (Lederer, 2020).

In November, the Centers for Disease Control and Prevention (CDC) released data identifying over 100,000 excess U.S. deaths “indirectly” associated with the pandemic (Rossen et al., 2020), including a “stunning 26.5% jump” in excess deaths in young adults in their mid-twenties through mid-forties (Prestigiacomo, 2020). Commenting on these mortality data — which reflect “a death count well beyond what [researchers] would normally expect” (Preidt, 2020) — the former U.S. Food and Drug Administration (FDA) Commissioner Scott Gottlieb voiced his suspicion that “a good portion of the deaths in that younger cohort were deaths due to despair,” including drug overdoses (Squawk Box, 2020). University researchers writing about mortality in JAMA concurred that “Excess deaths attributed to causes other than COVID-19 could reflect deaths . . . resulting from disruptions produced by the pandemic” (Woolf et al., 2020), including “spillover effects . . . such as delayed medical care, economic hardship or emotional distress” (Preidt, 2020). Multilateral entities like the Organisation for Economic Co-operation and Development (OECD) emphasize that it will be essential to assess the long-term impact of “confinement and deteriorating financial conditions” on mortality and warn that the social and economic fallout is likely to be “significant” (Morgan et al., 2020).

As an ideology, technocracy is recognized for exalting knowledge and expertise as the principal sources of legitimate power and authority and for asserting that there is “one best way” that only “the experts” (e.g., engineers, scientists, and doctors) can determine (Burris, 1989). However, critics of technocracy have long pointed out that, particularly in crisis situations, the know-how, “discretionary interventions” and seemingly “elastic” power claimed by technocrats can end up blurring the line between useful expertise and “arbitrary rule” (White, 2020). Moreover, technocrats typically resist attempts to make explicit “the non-rational attributes of technocratic decision-making” (Burris, 1989).

With the noticeable absence of any cost-benefit analysis and the increasingly “non-rational” justifications being put forth for Covid-19 restrictions (Handley, 2020; Kristen, 2020; Kulldorff et al., 2020; The Reaction Team, 2020) — as well as the economic, political, social, and cultural changes rolling out at dizzying speed — it is important to try to understand the technocratic and financial agendas at play. Three increasingly interwoven sectors (Big Finance, Big Tech, and Big Pharma) are reaping rewards from Covid-19, benefiting from close relationships with the military-intelligence apparatus (Glaser, 2020; Usdin, 2020). This rapid review seeks to (1) identify some of the pandemic’s principal beneficiaries (financial and otherwise) across these sectors, and (2) assess these parties’ actions in the context of the accelerating global push for technocratic consolidation and control through invasive surveillance.

Methods

Rapid reviews are used to synthesize evidence in a streamlined manner, abbreviating the timeline and requirements of more involved systematic reviews (Ganann et al., 2010). A rapid review is particularly well suited to emerging current event sequences, and the dynamic Covid-19-related situation certainly qualifies. Though not exhaustive, rapid reviews make it possible to quickly summarize available evidence across multiple disciplines, whether for the purpose of informing policy-making and decision-making or to identify patterns and take stock of the bigger picture.

For the purposes of this broad overview of current events, we relied primarily on the so-called grey literature as well as media accounts (from both the legacy media and independent journalists) and various online sources. We also consulted relevant peer-reviewed literature. Notably, while the peer-review process is ordinarily slow-moving, Covid-19-related studies have been making their way through the pipeline at breakneck speed (Packer, 2020).

Examples of sources consulted for this review include conventional and alternative financial commentary; webpages and communications from public health agencies, international organizations, and universities; individual blogs and commentary; and peer-reviewed studies cataloguing the impact of Covid-19 restrictions.

Big Finance

Assisted by the media, commentators have had an easy time framing the events of 2020 principally as a health crisis. With each passing month, however, those claims wear thinner (Barnett, 2020). In a comprehensive analysis titled The State of Our Currencies, former U.S. Assistant Secretary of Housing Catherine Austin Fitts (2020a) offers a broader and more instructive interpretation. Informed by close attention to financial patterns, Fitts asserts that the “shock doctrine” measures being imposed under cover of Covid-19 are helping lay the train tracks for a new global central banking machine and a technocratic “regulatory and economic model that permits far greater central control.”

Fitts calls attention to G7 central bankers’ August 2019 approval in Jackson Hole, Wyoming of a plan called “Going Direct” (Bartsch et al., 2019) that makes the case for a novel “blurring [of] the lines between government fiscal policy and central bank monetary policy” (Martens & Martens, 2020). Drafted months before Covid-19, the plan — co-branded by the World Economic Forum (n.d.) as “the Great Reset” — evokes the prospect of a serious economic downturn and “unusual circumstances” that could be used to justify “unprecedented” global measures (Bartsch et al., 2019).

Fitts (2020a) postulates that central bankers have both a short-term aim (to extend the existing dollar-based reserve currency system) and an ambitious longer-term goal: to implement a “new global governance and financial transaction system, and gather the power necessary to herd all parties into the new system”. Characterizing these aspirations as nothing short of ending currency as we know it, Fitts suggests that the top-down digital-currency-based model being promoted as a replacement could end up sidelining traditional intermediaries and instead directly furnish populations with something akin to a “credit at the company store”. Spelling out the implications of such a model, Fitts notes that with the help of digital surveillance and a social credit system, the central-bank-controlled “credit” could easily be “adjusted or turned off on an individual basis”. General Manager Agustín Carstens of the Bank for International Settlements (BIS) — the central bank of central banks — recently acknowledged as much, stating that in stark contrast to cash, a Central Bank Digital Currency (CBDC) would give central banks “absolute control” over CBDC use “and the technology to enforce” CBDC rules and regulations (International Monetary Fund, 2020). With a vaccine-injected digital surveillance program in individuals, the CBDC would have dictatorial power at the level of individual buying and selling.

Fitts’ analysis suggests that central bankers began laying the groundwork for the desired global transition well in advance of the coronavirus mayhem. In 2019 alone, G7 finance ministers endorsed a cryptocurrency action plan in July; in August, the G7 central bankers approved “Going Direct”; in September, the U.S. Federal Reserve (“the Fed”) started making hundreds of billions of dollars in loans “direct” to Wall Street trading houses; and in October, the BIS issued a major report on global cryptocurrencies (Bank for International Settlements, 2019; Helms, 2019; Fitts, 2020a; Martens & Martens, 2020). In the middle of the frenzy of central bank activity in October, the Bill & Melinda Gates Foundation (along with the World Economic Forum and Johns Hopkins Center for Health Security) held the well-publicized “pandemic tabletop exercise” called Event 201, which played out a global coronavirus outbreak scenario strikingly similar to 2020’s actual events (Center for Health Security, n.d.).

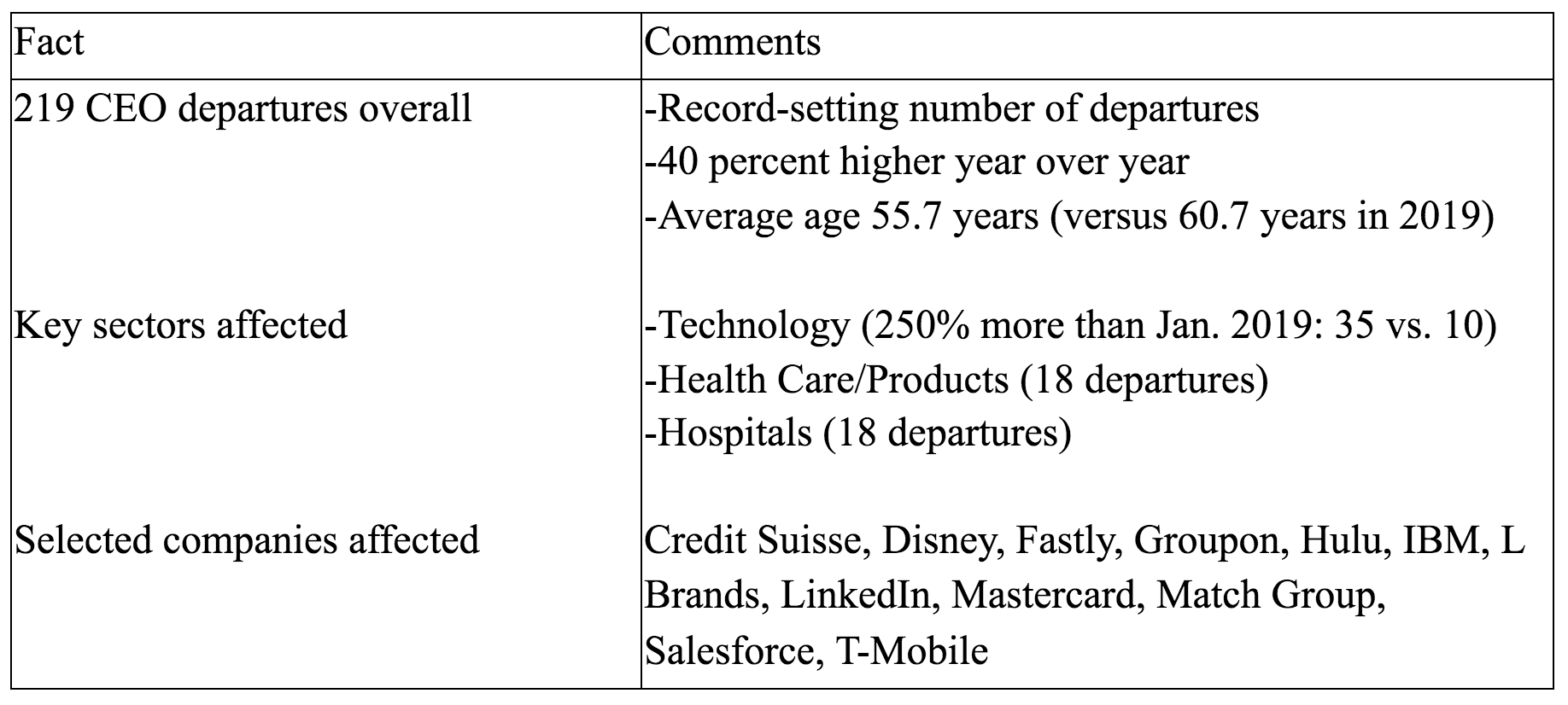

In January 2020, U.S. corporations witnessed a record number of CEO departures (Ausick, 2020; Marinova, 2020) — a mass exodus that strategically allowed over 200 departing executives to sell their stock at or near the market high (see Table 1). Other wealthy and influential insiders also engaged in surprisingly well-timed stock market transactions. For example, following a late-January, behind-closed-doors briefing about the virus (which had yet to affect a single American), certain U.S. senators sold hundreds of thousands of dollars of stock, “unloading shares that plummeted in value a month later” (Lane, 2020). The world’s wealthiest person, Amazon CEO Jeff Bezos, sold nearly $4.1 billion over an 11-day period in early February after having also sold $2.8 billion in shares in August 2019 (Palmer, 2020).

Table 1. U.S. CEO Departures in January 2020

As the U.S. government turned on the stimulus spigot in March, the Fed sustained its irregular intervention in the U.S. economy. By the summer of 2020, the Fed had expanded its balance sheet by $2.9 trillion — much of it unaccounted for, according to Fed-watcher John Titus (2020) — and financial observers were warning that “the market is no longer the biggest factor in selecting [economic] winners and losers” (Whalen, 2020). Titus (2020) concurs with this assessment, baldly characterizing 2020’s events as a Fed-led “coup d’état”. Titus (2014) has been chronicling major financial forces and legal changes since the 2008 financial crisis, describing how central banks are not only able to “loot” the American people “in broad daylight” but can do so without fear of prosecution — probably because, as Titus and Fitts (2020a) both point out, the Department of Justice depends on Fed member banks for its financial operations.

The coronavirus stimulus has provided abundant financial opportunities advantageous to Fed member banks. Over a two-week period in April, for example, large banks earned $10 billion in fees (ranging from 1 to 5 percent) simply for processing the government’s loans to businesses (Sullivan et al., 2020). Class-action lawsuits subsequently alleged that the banks prioritized larger loans (and larger companies) in order to garner the largest fees, while shutting out “tens of thousands” of eligible but smaller businesses (Sullivan et al., 2020). Serving as lender to the parent company of a national restaurant chain, Fed member bank JPMorgan Chase (the largest and most profitable bank in the U.S.) earned a $100,000 fee for a single “one-time transaction for which it assumed no risk and could pass through with fewer requirements than for a regular loan” (Sullivan et al., 2020).

In September, Senator Marco Rubio (Chairman of the Senate Committee on Small Business and Entrepreneurship) wrote to the JPMorgan Chase CEO expressing “alarm” about allegations that JPMorgan employees “may have been involved in potentially illegal conduct” in the distribution of Paycheck Protection Program and Economic Injury Disaster Loan funds (Rubio, 2020). Bloomberg later confirmed the possibility of Covid-19-related banking abuse on a wide scale (David, 2020). Importantly, this is not a new pattern of behavior for the U.S. banking behemoth. Since 2002 (and primarily since the 2008 financial crisis), JPMorgan Chase has paid out at least $42 billion in settlements for questionable, unethical, or illegal behavior (Fitts, 2019); its public-facing Wikipedia page lists involvement in 22 different “controversies,” including the economically shattering Enron and Madoff scandals (“JPMorgan Chase”, n.d.). Nevertheless, JPMorgan continues to earn glowing accolades from the financial community. In June 2020, Forbes urged investors to “bank on the best” in the uncertain Covid-19 environment (Trainer, 2020), citing JPMorgan’s post-2009 “industry-leading profitability” and asserting that the bank is exceptionally well positioned to expand its market share both during and post-pandemic. In October, JPMorgan rolled out a new smartphone credit card reader designed to compete with Square and PayPal (Son, 2020).

Big Tech

By July 2020, global billionaires’ wealth had surged to an all-time high of $10.2 trillion — an increase of 27.5 percent since April, and a 41.3 percent increase for tech billionaires (Phillipps, 2020). U.S. billionaires accrued a significant share of this pandemic wealth bonus, increasing their worth by $845 billion from mid-March to mid-September and prompting the observation that “for American billionaires specifically, things have never looked better” (Lerma, 2020). As a whole, U.S. billionaires’ wealth reached the equivalent of almost one-fifth of the U.S. gross domestic product, with four tech billionaires (Jeff Bezos, Bill Gates, Elon Musk, and Mark Zuckerberg) plus Warren Buffett seeing their total wealth climb by 59 percent (da Costa, 2020). Calling attention to Bezos, in particular, the Institute for Policy Studies described his surge in wealth as “unprecedented in modern financial history”, requiring “a real-time hour-by-hour tracker” to keep up (Collins et al., 2020).

The companies with which top-tier billionaires are affiliated include Amazon and Amazon Web Services (Bezos), Apple (Tim Cook), Facebook (Zuckerberg), Google/Alphabet (Larry Page and Sergey Brin), Microsoft (Steve Ballmer and Gates), Oracle (Larry Ellison), Zoom (Eric Yuan), and the variety of companies (including Neuralink, SpaceX, and Tesla) spearheaded by Musk (Alcorn, 2020; Collins et al., 2020; Toh, 2020). In July, as Bloomberg described these companies’ “outsized influence on U.S. markets”, it noted that they are as well-situated to profit from the U.S. shutdown as they are to take advantage of a recovering Europe and Asia — a “one-two punch” that has already increased FAANG companies’ market (Facebook, Amazon, Apple, Netflix, and Google, plus Microsoft) by 62 percent (Ritholtz, 2020). Suggesting that Silicon Valley will go down in history as “the standout sector” (Divine, 2020a), a U.S. News analyst unabashedly recommended Facebook as a 2020 “best buy” because “it’s gobbling up the world, and reasonable people could argue that if privacy is dying, individual investors may as well profit alongside Silicon Valley” (Divine, 2020b).

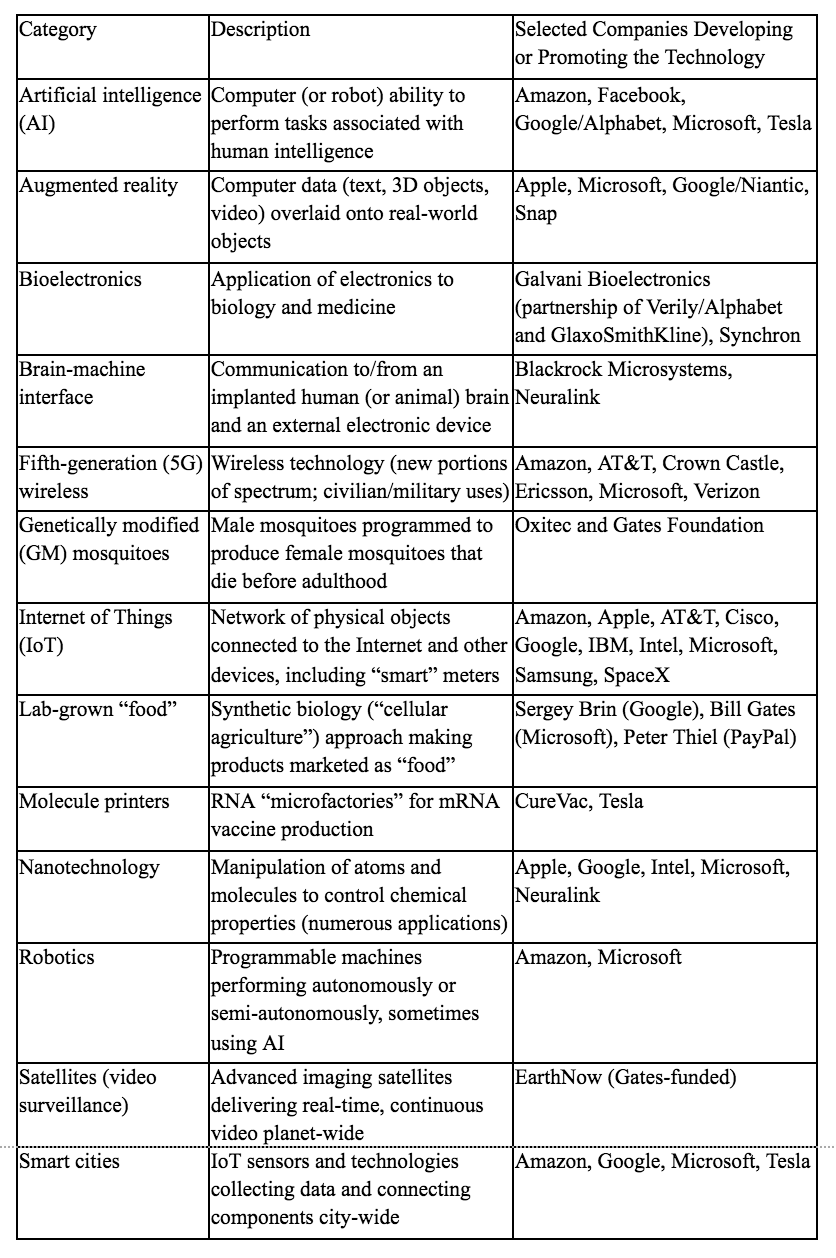

Covid-19 has provided Big Tech (and Big Telecom) with an opportunity to bring a range of controversial technologies further out into the open, despite many unresolved concerns about safety and ethics (Boteler, 2017; Gohd, 2017; Ross, 2018; Boyle, 2019; Feiner, 2019; Markman, 2019; Plautz, 2019; Zhang et al., 2019; Bajpai, 2020; Goodwin, 2020; Gyarmathy, 2020; McGovern, 2020; Novet, 2020; Reuters, 2020; Tucker, 2020; U.S. Department of Defense, 2020). Singly and in combination, the technologies (some of which are listed in Table 2) have the potential to usher in unprecedented societal changes, strengthening technocrats’ ability to control many facets of daily life. Artificial intelligence (AI), 5G, “smart” utility meters, and the Internet of Things (IoT), for example, are rapidly and fundamentally changing the nature of cities, businesses, and homes — what Fitts (2020a) calls the “final mile” — forming an essential part of the strategy to convert the economic model to a technocratic model that uses AI and software to achieve centrally controlled resource allocation.

Table 2. Covid-19 and the Rollout of Control Technologies

In October 2020, the World Economic Forum — the Great Reset’s front-row marketer — released a report on the future of jobs, describing the significant displacement of workers resulting from the pandemic and the related global restructuring that the organization has been taking the opportunity to promote (Petzinger, 2020). With automation and Covid-19 causing a “double-disruption” that is not only accelerating job destruction in the short term but “shrinking opportunities” in the longer term, the report solemnly pronounced a “new division of labour between humans, machines and algorithms” (World Economic Forum, 2020). Well before the pandemic, Amazon had established a robot-centric system at its fulfillment centers, with a process focused on “limit[ing] movement of people [and] let[ting] robots move everything” (Masud, 2019). This downsizing of humans has apparently served Amazon well; by May 2020, Amazon’s e-commerce business had shot up by 93 percent compared to the previous May (Klebnikov, 2020).

A September 2020 survey showed that many other companies plan to substantially boost their spending on AI and machine learning, citing Covid-19 as their rationale for prioritizing “the adoption of new technologies that enhance and enable automation” (Shein, 2020). Observers also predict, however, that the AI gold rush will lead to even more market consolidation and control by Amazon and three other big Covid-19 winners — Alphabet, Facebook, and Microsoft. These four companies, according to Forbes, have the “scale to push the envelope”, the “talent and the technology to perfect [AI]”, and the computing power to dominate the field (Markman, 2019). Amazon already controls nearly 46 percent of the worldwide public cloud-computing infrastructure that is a key backstop for AI functions such as parallel processing and the digestion of Big Data (Atlantic.Net, 2018; Nix, 2019).

Before Covid-19, consumer rejection of 5G wireless technology had been growing (Castor, 2020). However, the imposition of social distancing measures, remote learning, and online work requirements has provided the telecommunications industry with a ready-made pretext to fast-forward 5G’s deployment while attempting to burnish the industry’s unfavorable public image. Taking advantage of virus fears, Big Tech and Big Telecom are claiming that 5G can help enable “a future in which business, health care and human interaction must be at more than an arm’s length” (Wasserman, 2020). Forbes has praised communication service providers for responding to the coronavirus lockdowns “with a sense of urgency, purpose and empathy” (Wilson, 2020). Describing areas requiring more “advanced connectivity”, a technology expert at Deloitte Consulting cited the example of “cameralytics” (video surveillance) “to help worker safety and social distancing” (Howell, 2020). Whatever the rationale, the reality on the ground has been a massive increase in U.S. telecom companies’ capital spending on 5G and a “full steam ahead” rollout of spectrum and infrastructure that has placed the U.S. “ahead of schedule” (Knight, 2020; Ludlum, 2020). The European Commission is now attempting to follow the U.S.’s lead by pushing for the removal of “regulatory hurdles” and making the case that 5G will aid the region’s post-coronavirus economic recovery (McCaskill, 2020).

Covid-19 has also brought another of Big Tech’s interests into sharper focus: food. Billionaires such as Bill Gates and Peter Thiel have, for some time, been investing in biotech start-ups that aim to produce, in a lab, stem-cell-based “meat”, “fish”, “dairy”, and “breastmilk” (Kerr, 2016; Kosoff, 2017; Beres, 2020; Wuench, 2020). These start-ups and their investors have been only too happy to position the burgeoning industry as a partial solution to pandemic-related food insecurity and supply chain interruptions (Galanakis, 2020; Pereira & Oliveira, 2020; Yeung, 2020), welcoming Covid-19 as an “accelerator” as well as an opportunity to overcome consumer skepticism (Siegner, 2019; Morrison, 2020). In addition, as the coronavirus breathes new life into the term “sustainability” — long used by technocrats as a cover term for more centralized control (Wood, 2018) — global partners like the United Nations and the World Economic Forum are making the improbable claim that the complex, high-dollar, lab-created food substitutes (which require genetically stable cell lines, bioreactors, “edible scaffolds”, and cell culture media) are a “sustainable” option (Whiting, 2020). The biopharma giant Merck is also getting in on the “cultured meat” action, offering to make its “extensive knowledge of the relevant science and biotechnology” available to companies seeking to overcome “critical technological challenges” (Whiting, 2020). Merck frequently collaborates with the Gates Foundation, including in the development of Covid-19 vaccines (Lardieri, 2020).

Big Pharma

In September 2019, an annual Gallup poll reported that the restaurant industry was America’s top-ranked and most-liked among the 25 industries regularly assessed by the polling group (McCarthy, 2019). Sadly, less than a year later the Independent Restaurant Coalition predicted the permanent demise of up to 85 percent of independent restaurants (Jiang, 2020). In contrast, the pharmaceutical industry came in “dead last” in the 2019 poll, despite $9.6 billion spent annually on direct-to-consumer advertising and another $20 billion on marketing to health professionals (McCarthy, 2019; Schwartz & Woloshin, 2019). The U.S. is one of only two countries in the world that allows drug companies to market directly to consumers and, in non-election years, roughly 70 percent of news outlets’ advertising revenues come from pharma (Solis, 2019).

The pharmaceutical industry’s history of “fraud, bribery, lawsuits and scandals” is well known (Compton, n.d.), and no less a figure than Bill Gates has suggested that the public perceives Big Pharma as “kind of selfish and uncooperative”; however, Mr. Gates and Fortune magazine propose that Covid-19 may offer the industry an opportunity for “redemption” (Leaf, 2020). The stage may have been set for Big Pharma’s year of opportunity in January, when JPMorgan Chase held its 38th annual invitation-only health care conference. The business press describes the yearly conference as “one of the biggest biotech dealmaking events, often setting the tone for funding rounds, partnerships and mergers and acquisitions” (Leuty, 2020). Thus, just when the coronavirus ball was getting rolling, the conference brought an estimated 20,000 venture capitalists, investment bankers, and drug development executives and entrepreneurs to San Francisco to hear keynote addresses by JPMorgan’s and GlaxoSmithKline’s CEOs and to stoke expectations of a strong year for the biotech-plus-pharma chimera known as “biopharma” (JPMorgan, n.d.; Leuty, 2020; Lipschultz, 2020). In 2014, McKinsey & Company described the investment opportunities in biopharmaceuticals as “big and growing too rapidly to ignore”, with an annual growth rate more than double that of conventional pharma and a 20 percent share of global pharmaceutical revenues (Otto et al., 2014).

A few weeks after the JPMorgan conference — and well before any Covid-19 deaths in the U.S. — the Department of Health and Human Services (HHS) helped ensure that significant pandemic benefits would flow into the biopharma and medical space. HHS did so by issuing a declaration (on February 4) making vaccines and all Covid-19-related medical countermeasures immune from legal liability (HHS, 2020a). On March 6, roughly a week after the first reported coronavirus death, President Trump sweetened the pot by signing into law the first in a series of emergency stimulus packages, earmarking 40 percent of the $8.3-billion bill for vaccines and drugs under terms the pharmaceutical industry openly dictated (Karlin-Smith, 2020).

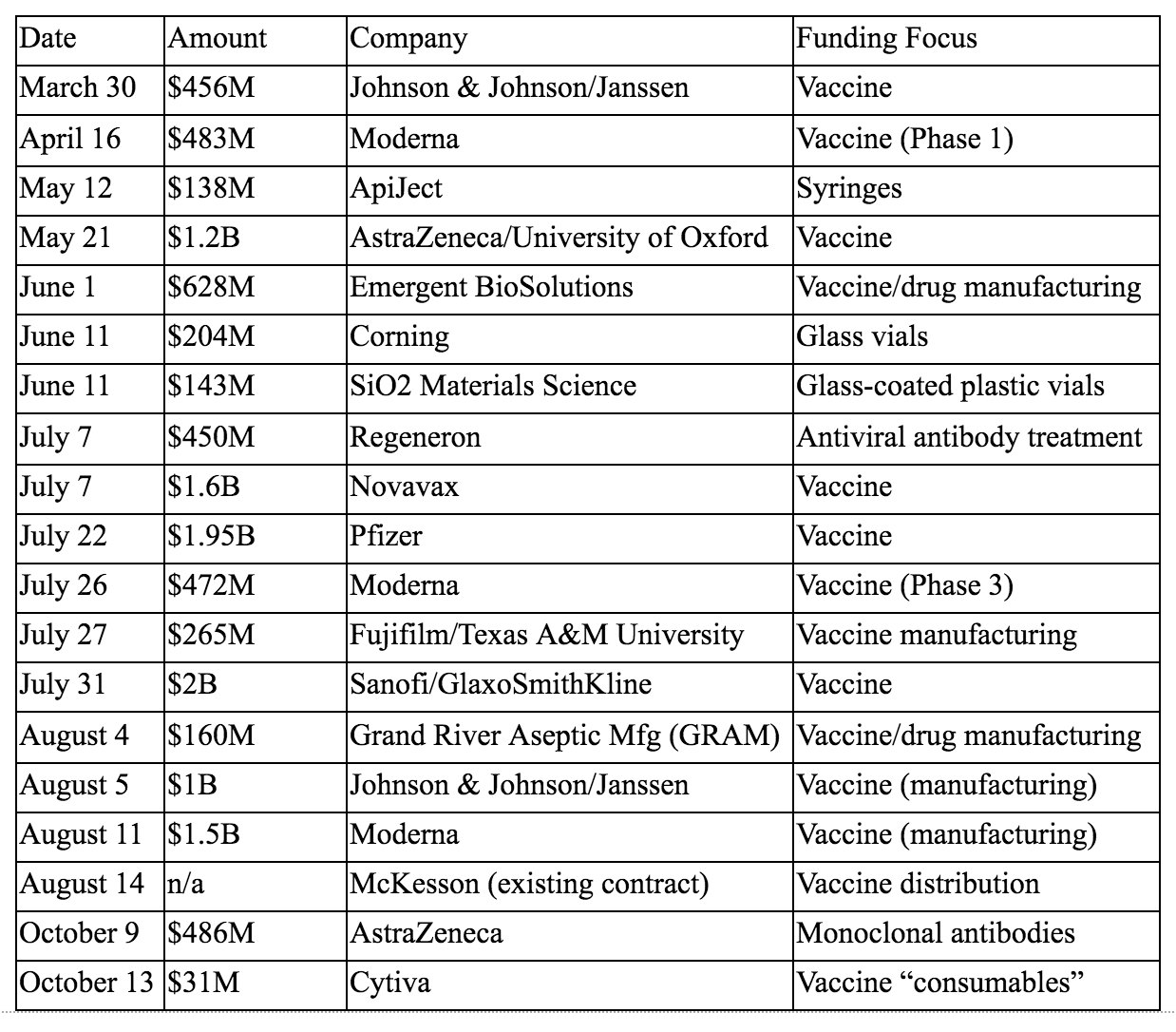

Following the February 4 HHS declaration eliminating legal liability, Bill and Melinda Gates instantly pledged $100 million in funding for coronavirus vaccine research and treatments, followed by another $150 million in mid-April (Bill & Melinda Gates Foundation, 2020; Voytko, 2020). When Operation Warp Speed followed, making untold billions available for research and development of therapeutics and vaccines at taxpayer expense (see Table 3), dozens of biopharma companies jumped into the fray (HHS, n.d.). Catherine Austin Fitts notes that a system that exempts from liability anything labeled as a “vaccine” amounts to “an open invitation to make billions . . . particularly where government regulations and laws can be used to create a guaranteed market through mandates” (Fitts, 2020b). Moreover, each time the CDC’s Advisory Committee on Immunization Practices (ACIP) adds a given vaccine to the CDC schedule, it is not only the equivalent of a “golden ticket” for the vaccine manufacturer but also directly benefits the CDC, which owns dozens of vaccine-related patents and routinely shares licensing agreements with manufacturers (Taylor, 2017; Children’s Health Defense, 2019).

Currently, there is one injury for every 39 vaccinations administered (2.6%), often resulting in a “disastrous outcome of life-altering iatrogenic illnesses” (Harvard Pilgrim Health Care, n.d.; Kennedy Jr., 2019; Kristen, 2019). A CDC study published in JAMA in 2016 reported that one in five young children (19.5%) under age five who were admitted to emergency rooms for drug reactions were suffering from vaccine injuries (Shehab et al., 2016). Early clinical trial results and Covid-19 vaccines’ use of an array of experimental, never-before-approved technologies suggest that comparable (or worse) levels of injury could follow the rollout of coronavirus vaccines (Children’s Health Defense, 2020a, 2020c, 2020d, 2020e). The Moderna and Pfizer vaccines, for example, feature mRNA molecules that are known to be “intrinsically unstable and prone to degradation”, with an inflammatory component that risks dangerous immune reactions (Feuerstein, Garde, & Joseph, 2020; Jackson et al., 2020; Wadhwa et al., 2020). Assuming the same vaccine injury rate of 2.6 percent, Operation Warp Speed’s projected vaccination of roughly 25 million Americans per month (Owermohle, 2020b) could conceivably result in 3.9 million injuries over just the first six months. (Given that the leading vaccines will require two initial doses and probable boosters thereafter, this figure could even be an underestimate.) If Bill Gates and other technocrats succeed in their declared aspiration to manufacture billions of doses of coronavirus vaccine and “get them out to every part of the world” (Gates, 2020), the scale of injury would not only be unprecedented but could open a lucrative, long-term gateway to the wider drug market to manage the injuries (Kristen, 2019).

Table 3. U.S. Taxpayer Monies Awarded to Pharmaceutical and Other Companies via Operation Warp Speed* (March–October, 2020), in Millions (M) or Billions (B)

By mid-October, 44 candidate vaccines were in clinical evaluation worldwide, with another two hundred or so in the pipeline (Agrawal et al., 2020; World Health Organization, 2020b). Furnishing predictably uncritical coverage ensured by the pharmaceutical industry’s strategic entanglements with the media, scientists, and medical journals, the press has been telling the public that the vaccines will play “an important role in most response scenarios”, including “‘sav[ing] the world’ in worse scenarios” and serving as an “insurance policy against continued health and economic shocks” (Agrawal et al., 2020). Only a handful of journalists have called attention to Big Pharma’s pandemic profiteering, pointing out that “insiders at companies developing experimental vaccines and treatments . . . aren’t waiting until they finish the job to collect their reward” (Wallack, 2020).

An October piece in the Boston Globe cited the example of Moderna (Wallack, 2020). It took Moderna a mere three weeks after Bill Gates’ initial funding installment to send its first batch of experimental vaccine to research and patent partner, the National Institute of Allergy and Infectious Diseases (NIAID), leading to an immediate surge in share price of 28 percent (Lee, 2020; Loftus, 2020). By early April, Moderna’s CEO had become an overnight billionaire; by October, he had sold nearly $58 million in stock, followed by another $2 million in mid-November, just ahead of the company’s intended filing for vaccine Emergency Use Authorization (Nagarajan, 2020; Tognini, 2020; Wallack, 2020). Meanwhile, Moderna’s chief medical officer has been “systematically liquidating all of his company stock” — about $70 million — “in a series of pre-planned trades that have made him roughly $1 million richer each week” (Wallack, 2020). Thus far this year, company insiders have sold $309 million in stock versus under $2 million in 2019, fueling suspicion that they may be “downplaying possible obstacles to goose stock prices — and increase their personal profits” (Wallack, 2020). Also among those selling Moderna stock options is Moncef Slaoui, the former Moderna board member and former GlaxoSmithKline executive who now heads up Operation Warp Speed (Rozsa & Spencer, 2020).

From Moderna’s perspective, the Covid-19 vaccine represents a lifeline, rescuing the company from a shaky bottom line due to its prior inability to bring any products to market (Garde, 2017; Nathan-Kazis, 2020). Other biopharma companies formerly on the skids are likewise poised to make record profits from the coronavirus (Webb & Diego, 2020). Characterizing the business model for Covid-19 (and other) vaccines as a “great scheme” — particularly given the HHS-guaranteed, risk-free environment — a watchdog group spokesman told the Boston Globe, “Taxpayers cover the upfront investment costs and shoulder any downside, while their [biopharma’s] executives and shareholders can capture the upside if their drugs pan out and are shoveling obscene amounts of money into their pockets throughout the process” (Wallack, 2020). In the words of a business school professor, “You announce a sliver of positive hope about a product and your stock price goes up,” even though “the chances of that product panning out might be relatively low” (Wallack, 2020). In 2020, the company Vaxart saw its per-share stock price rise from 27 cents to a high of $17.49 (Wallack, 2020).

Rolling Stone journalist Matt Taibbi (2020) describes Covid-19 as “the ultimate cash cow,” a “subsidy-laden scam,” and a legal opportunity for “giant-scale gouging”, quoting a legislator who admits that while the public is paying for the research and manufacturing, “the profits will be privatized”. Writing in August about how the government-subsidized business model played out for Gilead’s drug remdesivir, Taibbi (2020) recounted: “Gilead, a company with a market capitalization of more than $90 billion, making it bigger than Goldman Sachs, develops an antiviral drug with the help of $99 million in American government grant money. Though the drug may cost as little as $10 per dose to make, and is being produced generically in Bangladesh at about a fifth of the list price, and costs about a third less in Europe than it does in the U.S., Gilead ended up selling hundreds of thousands of doses at the maximum conceivable level, i.e., the American private-insurance price — which, incidentally, might be about 10 times what it’s worth, given its actual medical impact.”

Always a major lobbying presence on Capitol Hill, the pharmaceutical industry has been more lavish than usual with its political spending in 2020, donating over $11 million to individual candidates involved with health care policy and related political action committees (Facher, 2020a). Although the overall amounts represent a pittance for companies earning tens of billions a year, pharma and its lobbying groups recognize that “small chunks of corporate change”, when strategically allocated, “can have a significant impact” (Facher, 2020b). Coronavirus vaccine frontrunner Pfizer, the second-largest drug and biotech company in the world and the fourth-highest earner of vaccine revenues (Statista, n.d.; Hansen, 2020), has been the top political spender, likely laying the groundwork for its November 20 filing for Emergency Use Authorization for its coronavirus vaccine (Chander, 2020; Children’s Health Defense, 2020d). Pfizer has also benefited from repeated endorsements from the financial community and self-proclaimed spokesmen like Bill Gates (Speights, 2020a, 2020b).

The Military-Intelligence Complex

Traditional vaccines have their fair share of safety problems, but coronavirus and other 21st-century vaccines promise to challenge bodily integrity and informed consent in entirely new ways, particularly given their strong reliance on various forms of nanotechnology (Health and Environment Alliance, 2008; Li et al., 2009; Chauhan et al., 2020; Children’s Health Defense, 2020a). Many of the technologies being rolled into Covid-19 vaccines and their delivery systems originated in the military sphere or benefited from Defense Advanced Research Projects Agency (DARPA) funding. DARPA has had a Biological Technologies Office since 2014 and, since the emergence of Covid-19, has specifically directed many of its pandemic-related efforts toward coronavirus therapeutics and vaccines (Gallo, 2020). Far from being suspect, the military’s role has been celebrated. A BioCentury report optimistically suggested in March that as an agency “that specializes in turning science fantasies into realities”, DARPA might offer the “best hopes” for Covid-19 biotech solutions due to its willingness to pursue “high-risk, high-reward technologies”, set goals “that defy conventional wisdom”, and go after its goals with a “laser” focus (Usdin, 2020).

One of the principal DARPA-incubated vaccine technologies to gain prominence in the Covid-19 era are the nucleic acid (mRNA and DNA) vaccines that turn the human body into its own “bioreactor” (Ghose, 2015; Usdin, 2020). Vaccines using mRNA (such as Moderna’s and Pfizer’s) — which developers compare to “software” (Garde, 2017) and praise for their “programmability” (Al-Wassiti, 2019) — target the cell’s cytoplasm and rely on delivery technologies such as lipid nanoparticles to “ensure stabilization of mRNA under physiological conditions” (Wadhwa et al., 2020). DNA vaccines (such as Inovio’s) are intended to penetrate all the way into a cell’s nucleus and come with the risk of “integration of exogenous DNA into the host genome, which may cause severe mutagenesis and induced new diseases” (Zhang, Maruggi, Shan, & Li, 2019). Describing the scientific community’s early doubts about nucleic acid vaccines — arising from the potential for “many things” to go wrong — a DARPA program manager recently noted, “It was something that was much too risky for groups like the NIH to fund” (Usdin, 2020).

Risks aside, DARPA and vaccine manufacturers are attracted to one chief benefit of nucleic acid vaccines: They can be developed much more quickly and cheaply. Other military-initiated technologies are also coming into view with Covid-19 vaccines. These include electroporation, which applies a high-voltage electrical pulse to make cell membranes permeable to a vaccine’s foreign DNA (Inovio Pharmaceuticals, 2020); syringe-injected biosensors that enable continuous wireless monitoring of vital signs and body chemistry (Peer, n.d.; Profusa, n.d.; Diego, 2020b; Tucker, 2020); and the quantum-dot-based infrared detectors that are under discussion as a tool for tracking vaccination status (Johnson, 2011; Trafton, 2019). DARPA has also played a leading role in developing and funding technologies that “blur the lines between computers and biology”, including brain-machine interfaces and neuromonitoring and mind-reading devices (CB Insights, 2019; Gent, 2019; Tullis, 2019).

Some of Moderna’s earliest funding came from DARPA, which awarded the company $25 million in 2013 to develop the mRNA platform that has become a key feature of its coronavirus vaccine (Usdin, 2020). Other DARPA beneficiaries now involved in efforts to develop Covid-19 vaccines or therapeutics include AbCellera Biologics, CureVac, Inovio Pharmaceuticals, Regeneron Pharmaceuticals, and Vir Biotechnology; some of AbCellera’s partners include major players like Pfizer and Gilead (Usdin, 2020).

The Pentagon’s involvement in coronavirus-related efforts goes well beyond DARPA-funded research. Four-star General Gustave Perna is serving as chief operating officer of Operation Warp Speed alongside chief advisor Moncef Slaoui. General Perna, in charge of U.S. Army Materiel Command, oversees the global supply chain for over 190,000 U.S. Army employees (HHS, 2020b). For the first time ever, the distribution of the eventual coronavirus vaccines is being planned as a “joint venture” between the CDC and the Pentagon, with the latter overseeing “all the logistics of getting the vaccines to the right place, at the right time, in the right condition” (Owermohle, 2020a). In a CBS “60 Minutes” appearance in early November, General Perna indicated that Operation Warp Speed already had doses of (currently unapproved) vaccine and syringes stockpiled and protected by armed guards, and intends to get them out the door “within 24 hours” of vaccine approval and delivered “to every zip code in this country” (Martin, 2020).

The Pentagon has indicated that private-sector involvement could be a key feature of the distribution strategy, and the private sector is positioning itself to participate. Merck, for example, is testing drone delivery of vaccines in partnership with Volansi, Inc., a company that provides “on-demand” drone services for the military (Landi, 2020; Simmie, 2020). In July, Merck’s CEO set the stage for its logistics involvement by describing vaccine distribution as “even a harder problem” than the “scientific conundrum of coming forward with a vaccine that works” (Murray & Griffin, 2020).

Outside the pharmaceutical arena, technological transformations that are speeding the world toward more centralized control also reveal the influence of the military-intelligence sector. For example, Amazon Web Services has held cloud-computing contracts with the CIA since 2013, with the original $600 million contract extending to all 17 intelligence agencies (Konkel, 2014). In October of 2019, the Department of Defense awarded the $10 billion JEDI cloud computing contract to Microsoft, a decision that Amazon has unsuccessfully disputed in court (Sandler, 2020). In early 2020, the U.S. Navy awarded a cloud computing contract to Leidos (Leidos, 2020).

5G, too, relies in part on the high-range millimeter-wave spectrum previously used almost entirely by the military for “non-lethal” crowd dispersal weapons (Joint Intermediate Force Capabilities Office, n.d.). In October, the Department of Defense announced it would spend $600 million to test “dual-use” applications of 5G to enhance the U.S. military’s “leap-ahead capabilities”, including applications such as 5G-enabled augmented/virtual reality, 5G-enabled “smart” warehouses, and 5G technologies “to aid in Air, Space, and Cyberspace lethality” (U.S. Department of Defense, 2020).

Both 5G and cloud computing are critical components of the Big Data and IoT build-out that is enabling the conversion of individual data into the “new oil” (Fitts, 2020a), and both have exploded in 2020 (Howell, 2020; Klebnikov, 2020). The technologies are essential to the “centrally controlled digital financial transaction systems” envisioned by central bankers, who plan to rely on seamless data flows to and from “every smartphone, community, and home without exception” (Fitts, 2020a).

Discussion

As more individuals and organizations connect the technocratic dots and look beneath the coronavirus pandemic’s seductively simple surface, it should become increasingly apparent that the pandemic profiteers do not have people’s best interests at heart. In The State of Our Currencies and other pandemic-related writings, Catherine Austin Fitts (2020a, 2020b) strongly emphasizes the importance of accepting that what is transpiring in the financial, tech, biopharmaceutical, and military-intelligence sectors is interconnected. Part of this involves recognizing that the coronavirus vaccines currently dominating the headlines represent something likely to go far beyond the simple health intervention being held out by scientists and officials as a panacea. Instead, the evidence suggests that Covid-19 vaccines are intended to serve as a Trojan horse to transport invasive technologies into people’s brains and bodies. These technologies could include brain-machine interface nanotechnology, digital identity tracking devices, technology that can be turned on and off remotely, and cryptocurrency-compatible chips (Fitts, 2020b).

In Fitts’ (2020a, 2020b) view, this type of intimate access — achieved “without notice, disclosure, or compensation” — represents the “final inch” of interest to technocrats. Together with external technologies to control behavior (Max, 2020), such access could permit the achievement of several goals: (1) replacing currencies with a digital transaction system, digital identification, and tracking (an “embedded credit card system”); (2) creating a global control grid that connects the population to the military-intelligence clouds; and (3) obtaining continuous access to valuable individual data on a 24/7 basis (Fitts, 2020b). Countries in West Africa are already piloting a venture by the Gates Foundation, the Gates-funded GAVI vaccine alliance, and Mastercard that “marks a novel approach towards linking a biometric digital identity system, vaccination records, and a payment system into a single cohesive platform” (Diego, 2020a). As Fitts (2020b) summarizes, “Just as Gates installed an operating system in our computers, now the vision is to install an operating system in our bodies and use ‘viruses’ to mandate an initial installation followed by regular updates”. The “neat trick”, as Fitts sees it, is that the use of vaccines as the delivery vehicle cancels out legal liability.

It is noteworthy that Bill Gates announced that he was stepping down from the Microsoft board of directors on March 13 — the same day that President Trump declared the pandemic a national emergency (Haselton & Novet, 2020). That same month, the Pentagon reaffirmed its intention for the JEDI cloud-computing contract to go to Microsoft (Rash, 2020; Sun, 2020). By distancing himself from the appearance of conflicts of interest with Microsoft’s Defense Department commitments and the Pentagon’s subsequent role in Operation Warp Speed, Mr. Gates had more freedom to make the rounds and begin promoting worldwide vaccination and digital certificates (Haggith, 2020). Gates has been less successful in distracting attention from other potential conflicts of interest. An exposé by The Nation (ironically also published in March) showed that the Gates Foundation gives billions to corporations in which the foundation holds stocks and bonds — including all of the major pharmaceutical companies — creating a “welter of conflicts of interest” (Schwab, 2020). A dozen years ago, around the time of the 2007-2008 financial crisis, the Los Angeles Times outlined the Gates Foundation’s numerous holdings in a number of notoriously “destructive or unethical” companies (Piller et al., 2007).

Mr. Gates is not the only party strenuously promoting digital IDs and “no-escape” financial tracking (marketed under the benevolent guise of “financial inclusion”). In October, Kristalina Georgieva, the International Monetary Fund’s (IMF’s) Managing Director, evoked “a world in which digital is the way in which financial transactions take place” and made it clear that she views universal digital IDs as a non-negotiable requirement for moving in the “right direction” (International Monetary Fund, 2020). Georgieva has, not unhappily, described Covid-19 as a “once in a lifetime pandemic” (Bello, 2020).

Georgieva’s remarks should be examined in the context of a proposal by the U.S. House of Representatives to bestow the IMF with $3 trillion “no-strings-attached” U.S. dollars as “coronavirus relief aid” (Huessy, 2020; Roberts, 2020). A U.S. taxpayer-funded gift of this magnitude would be unprecedented and would increase the IMF’s lending resources (called Special Drawing Rights or SDRs) by as much as 10-fold (Roberts, 2020). 2020’s events (including global debt entrapment and actual or potential food shortages) and the IMF’s bullying track record (Bello, 2020) suggest that the IMF could then wield the $3 trillion as a weapon, strong-arming countries into accepting an array of unwanted measures such as digital identities, forced vaccination, and eventually (as the World Economic Forum predicts), the relinquishment of private property (World Economic Forum, 2016). As a step in this general direction, the IMF has strongly praised India’s leadership in biometric identification systems. It celebrates the “delivery of social benefits through direct electronic payments to eligible bank account holders”, but glosses over the systems’ vulnerability to “unauthorized access” and the data breaches that are already rampant (Jha, 2018).

While current prospects for ordinary citizens certainly appear challenging, nothing is a foregone conclusion. Large-scale protests against the curtailment of civil rights have occurred and continue to occur in many countries, most notably in Germany (Depuydt, 2020). The Great Barrington Declaration — a statement crafted by public health scientists from Harvard, Stanford, and Oxford — has garnered signatures from over 12,000 scientists, over 35,000 medical practitioners, and nearly 639,000 citizens from around the world, all concerned about “the damaging physical and mental health impacts of the prevailing COVID-19 policies” (Kulldorff et al., 2020). Similarly, an Appeal authored in May by Archbishop Carlo Maria Viganò, former Apostolic Nuncio to the United States, gathered 40,000 signatures within a few days, with the signatories (religious leaders, doctors, journalists, lawyers, and other professionals) all seeking to draw attention to the threats to sovereignty and freedom that pandemic-related mandates have unleashed (Tosatti, 2020). Archbishop Viganò has also penned severe critiques of the Great Reset, describing its architects as “a global elite that wants to subdue all of humanity, imposing coercive measures [and a health dictatorship] with which to drastically limit individual freedoms and those of entire populations” (Viganò, 2020).

One of the signatories of Archbishop Viganò’s Appeal is attorney Robert F. Kennedy, Jr., founder and chief legal counsel of Children’s Health Defense, an organization dedicated to ending childhood epidemics by working to eliminate harmful exposures, holding those responsible accountable, and establishing stronger safeguards. In late October, Kennedy recorded a 19-minute video message to people around the world, describing the “coup d’état by big data, by big telecom, by big tech, by the big oil and chemical companies and by the global public health cartel” (Kennedy Jr., 2020). In his closing remarks, Kennedy also indicated that citizens who wish to maintain their freedoms cannot afford to remain complacent: “You are on the front lines of the most important battle in history, and it is the battle to save democracy, and freedom, and human liberty, and human dignity from this totalitarian cartel that is trying to rob us simultaneously, in every nation in the world, of the rights that every human being is born with.

Big-Picture Look at Current Pandemic Beneficiaries Accepted by Peer-Reviewed Journal