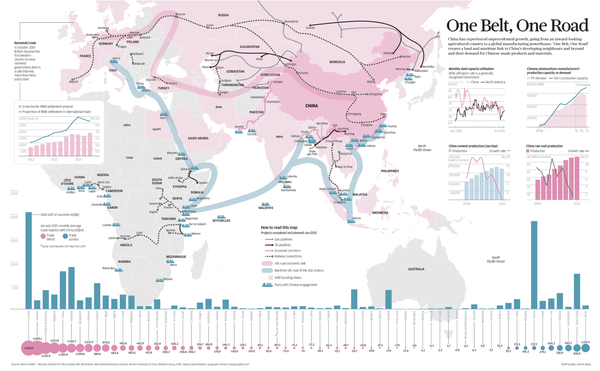

Author’s Introduction © F. William Engdahl China’s One Belt One Road–Transforming the World China’s One Belt, One Road project, initiated by President Xi Jinping during a meeting in 2013 in Kazakhstan is currently the largest real economy infrastructure project in the world. It is not merely about building faster rail pathways from China across Eurasia’s vast landmass to Europe to hasten freight delivery times, or about more efficient container ports across Eurasia and the Indian Ocean. It’s about transforming one of the previously most forgotten regions of the world into a vibrant and growing new economic space, about bringing technology and industry into some very backwater parts of Central Asia that also happen to be blessed with some of the world’s richest minerals concentrations. Without modern transportation infrastructure, those mineral and other riches lay dormant. While the over-indebted countries of the West from the United States to the European Union impose counter-productive austerity in a fruitless attempt to solve their economic stagnation, China and its allies along the One Belt, One Road have decided to take the lead in setting up a cooperation project of historic dimensions to use new markets along the belts to absorb Chinese domestic overcapacity. Already by early 2016 we see the opening of Iran-China trade in a new dimension, and the emergence of new energy hubs like Ethiopia and Mozambique. These will drive energy infrastructure. Growing industrial outsourcing to Africa in the garment and other light industries will drive the need for more container hubs and deep sea ports along the Indian Ocean coast. Newly established free trade zones along the extended Suez Canal will drive the development of the building material industry for rapidly urbanizing Egypt. Energy-hungry and populated Pakistan – where China is building a nuclear power plant – will see massive investments in grid, power systems, and energy-intensive industries like cement and glass, as well as transportation infrastructure. [i]In terms of the oceans the Maritime Silk Road, which connects China with sub-Saharan Africa as well as the Middle East and North Africa, including Iran, will create new deep water harbors and hubs in South Asia, East Africa, and the Arab peninsula for the secure and efficient transportation of oil and other strategic resources to China. China’s proposed maritime route will also reduce its current over-reliance on the Strait of Malacca for international shipping, a narrow corridor which is vulnerable to threats from closely watched by the powerful US navy. [ii]A New Silk Road For China the One Belt, One Road is also referred to as the New Economic Silk Road, a reference to the ancient Eurasian overland trade routes and sea routes linking China trade to that of all Eurasia, the now-Middle East and on to Venice and Europe some two thousand years ago initiated by China’s Han Dynasty. At that time, the Silk Road trade routes went from China through India, Asia Minor, up through Mesopotamia to Egypt, the African continent, Greece, Rome, and even Britain. The northern Mesopotamian region, today Iran, became China’s closest partner in trade, a relationship which is re-emerging today as China brings Iran into the One belt, One Road infrastructure network. China, whose civilization was then far more advanced than that of Europe, sent to Europe paper, an invention of China during the Han Dynasty. They sent gunpowder, and increasingly, silk, along with the rich spices of the east. By the time of the Roman Emperor Augustus, 27 BC – 14 AD, trade between China and the Roman Empire in the west was firmly established. Silk, whose origins the Chinese kept a state secret, was the most sought commodity in Egypt, Greece, and, especially, in Rome. More than the mere trade in goods from East to West and back, the original Silk Road made possible a vast cultural exchange between peoples in art, religion, philosophy, technology, language, science, architecture. Every aspect of civilization was exchanged through the Silk Road along with the trade goods the merchants carried from country to country. As China’s silk was the major trade product, German geographer Ferdinand von Richthofen coined it the Silk Road in 1877. It was not just one road but rather a series of major trade routes that helped build trade and cultural ties between China, India, Persia, Arabia, Greece, Rome and Mediterranean countries. [iii]Today’s One Road The historical reference is important to better understand that under President Xi Jinping China’s leadership today has drawn deeply into their cultural heritage in conceiving the new Silk Road, the One Belt, One Road. Few, even many in today’s China, realize the deeper importance of this initiative, not only for the economy of China. The plan involves more than 60 countries, representing a third of the world’s total economy and more than half the global population. Part of the New Economic Silk Road includes plans to route the rail projects of the Silk Road to enable more economic mining and export of gold, the world’s historically most beautiful of all metals. A recent sketch (above top) of the various land and sea routes for the New Silk Road indicates its enormous scope, though the current version (bottom) adds a direct rail link through Russia from Kazakhstan following the May, 2015 agreement between Putin and China’s XI (sources: Sources: Mercator Institute for China Studies (Merics), IMF, World Bank, International Monetary Institute, Renmin University of China) In May, 2015 China set up a state-run Gold Investment Fund to create an investment pool, initially of $16 billion, making it the world’s largest physical gold fund. It will support gold mining projects along the Economic Silk Road. China stated that the aim is to enable the Eurasian countries along the Silk Road to increase the gold backing of their currencies, a major step to currency stability that would facilitate foreign direct investment. China’s Shanghai Gold Exchange’s “Silk Road Gold Fund” initially has two main investors in the new fund. They are also China’s two largest gold mining companies. The fund will invest in gold mining projects along the route of the Eurasian Silk Road railways, including in the vast under-explored parts of the Russian Federation. The China gold mining cooperation extends to Russia, today rapidly becoming the closest strategic partner of China. China National Gold Group Corporation has signed an agreement with the Russian gold mining group, Polyus Gold, Russia’s largest gold mining group, and one of the top ten in the world, to explore the gold resources of Russia’s largest gold deposit at Natalka in the far eastern part of Magadan’s Kolyma District. While it is not widely known outside the gold mining industry, China is today the world’s largest gold mining country having passed the declining South African output several years ago. Russia is number three in the world. Kazakhstan and other Central Asian countries now on the Silk Road have large untapped gold reserves that will become economical with the link of rail infrastructure. [iv]Copper too China has also targeted the vast untapped copper reserves of the countries along the Silk Road. Mining experts estimate that China’s investments for strategic Silk Road copper supply will run into the tens or even hundreds of billions. In 2014 China was the largest importer of copper for its industry, drawing an impressive 40% of all world copper imports. Now the country clearly looks for more secure–Australia is a prime USA military partner for the Obama ‘Asia Pivot’ aimed at China–and more economical sources along the Silk Road. Kazakhstan, whose President Nursultan Nazarbayev proposed the idea of a new Economic Silk Road in a 2013 meeting with Xi Jinping, has been a significant focus for China copper agreements and joint projects. Kazakhstan has high-grades of copper in the east-central part, similar to Africa’s famous Copperbelt. It’s also technically easy to exploit. China Development Bank has provided $4.2 billion in credit to KAZ Minerals, a major Kazakh mining company. [v]Kazakhstan’s eastern region and bordering parts of northern Kyrgyzstan have a number of copper- bearing rock or porphries, estimated at billions of tons. That same porphyry belt extends into Mongolia, a new addition to China’s Silk Road. recently Mongolia confirmed a huge copper discovery, the Oyu Tolgoi mega-discovery with some 6.5 billion tons total resource. Other Silk Road copper prospects lie in Iran, Turkey should things calm there, and Serbia. [vi]Not only development of Eurasia’s vast untapped gold and copper resources interests Chinese companies. On December 17, a group of Chinese companies visiting Kazakhstan signed a number of major agreements with the world’s largest uranium producer. CGN Mining, a listed subsidiary of China General Nuclear Power Corporation, took a minority stake in Kazakh uranium deposits, in a deal that includes construction of a nuclear fuel assembly production plant. The entire fuel supply will go to fuel China’s growing nuclear power construction to offset coal power. During the same talks in Kazakhstan, China’s CEFC Energy bought a 51% share in a subsidiary of Kazakh state oil and gas firm KazMunayGaz, which operates refineries and gas stations, as well as fertilizer plants, across Europe. And China National Chemical Engineering agreed to construct a natural gas-fueled chemical complex in Kazakhstan. [vii]This is but the first of what will ultimately be a market spanning the largest land expanse in the world, Eurasia, with the world’s largest population, educated manpower, world-class scientists and engineers and a desire to build, not to destroy. Economic Security Initiation of the One Belt One Road at this juncture is also a strategic economic necessity for China and other Eurasian trade partners. The West, led by Washington, is pushing a trade agenda that deliberately excludes China in an effort to try to isolate and contain China’s economic weight in the world economy. China’s major trading partners are excluding it from potentially strategic agreements. Trans-Pacific Partnership (TPP) countries, the Transatlantic Trade and Investment Partnership and the EU-Japan agreement all have comprehensive liberalization agendas, but do not include China and have the potential to increase trading costs. In response, China plans to negotiate free-trade agreements with 65 countries along the One Belt, One Road. As of early 2016 China had signed 12 free-trade agreements including Singapore, Pakistan, Chile, Peru, Costa Rica, Iceland, Switzerland, Hong Kong and Taiwan. A further eight are under negotiation with Japan, Korea, Australia, Sri Lanka, Norway, the Regional Comprehensive Economic Partnership, Asean and the Gulf Cooperation Council. [viii] One Belt, One Road will have as much impact on China’s internal economy as it will have internationally. China’s top priority today is to stimulate the domestic economy via exports from industries with major overcapacity such as steel, cement and aluminum. Many will be build-transfer-operate schemes in which large State Owned Enterprises (SOEs) will lead the way, and then smaller companies will follow, somewhat along the model of the German economy after 1870. The domestic plan divides China into five regions with infrastructure plans to connect with neighboring countries and increase connectivity. Each zone will be led by a core province: Xinjiang in the Northwest, Inner Mongolia in the Northeast, Guangxi in the Southwest and Fujian on the coast. [ix] With the development of the vast Eurasian land space, the world has a golden opportunity to move away from destructive wars and economic depressions towards peaceful harmonious development. The following pages suggest the dimensions of this vast project for the future as well as the challenges–political and militarily, it faces. Endnotes:

[i] Michael Schaefer, Co-driving the New Silk Road, Berlin Policy Journal, January/February 2016. [iv] F. William Engdahl, The Worth of Gold Growing by the Day, NEO, 12 August, 2015, | | |